Sunday, December 12, 2010

US_Dollar_FOMC_Could_Drive_Volatility_but_Watch_the_SP_500_body_usdpostingpic.bmp, US Dollar: FOMC Could Drive Volatility, but Watch the S&P 500

US Dollar: FOMC Could Drive Volatility, but Watch the S&P 500

Fundamental Forecast for the US Dollar: Neutral

- US Dollar sinks against all major counterparts on rally in ‘risk’

- Chinese rate hike fears could drive risk-aversion and US Dollar strength

- View our monthly Euro/US Dollar Exchange Rate Forecast

The US Dollar rallied against almost all G10 currencies despite a strong week for ‘risk’ as the S&P 500 closed at fresh multi-year highs through Friday’s close. Correlations between key asset classes broke down in a week where we saw equities and bonds rally and fall at the same time, and the safe-haven US Dollar squeezed out gains despite ostensibly adverse conditions. Attention now turns to the coming week of potentially market-moving event risk, with the US Federal Open Market Committee decision and inflation data likely to cause ripples across global financial markets in the week ahead.

Markets very widely expect that the US Federal Reserve will leave monetary policy exactly unchanged through their upcoming decision, but it will be equally important to monitor for any shifts—no matter how subtle—in official rhetoric. The subsequent days of Consumer and Producer Price Index inflation data will likewise taken on renewed importance as the Fed embarks on controversial Quantitative Easing policies. Given that equity markets and financial companies have generally benefited from the highly accommodative monetary policy, the clear risk is that rising inflation would force the Fed to pull back measures to boost the economy. Likewise significant, recent fears on the future of US Government deficits have led to substantial rallies in US Treasury bond yields—thereby offsetting much of the effects of Quantitative Easing and tightening monetary conditions.

As we close in on the end of the year, it is easy to see that it has been a strong second-half performance for equity markets and a continuation in the secular downtrend for the US Dollar. Yet we maintain that the US Dollar is on pace for further recovery against the Euro and other key counterparts through the shorter-term. Whether this plays out through the final weeks of the year will almost certainly depend on whether stocks continue their recent torrid pace. Yet semi-frequent sharp declines in equities warn that risk sentiment remains fragile, and one gets the sense that any number of catalysts could spark renewed sell-offs in the S&P and other key asset classes. In the short term, watch market reactions around the FOMC result and a steady stream of US economic event risk. – DR

Saturday, December 11, 2010

FOREX-Euro falls as debt fears return; more losses seen

NEW YORK, Dec 6 (Reuters) - The euro snapped a three-day advance versus the dollar on Monday and selling pressure is likely to continue as doubts grew that European officials would find a common approach to ease the region's debt crisis.

The euro had earlier fallen more than 1 percent to around $1.3250 as traders took profits on its recent gains. The single currency could head back toward its 2-1/2 month low around $1.2970 set last week, traders said.

Yields on Italian, Spanish and Greek bonds and the cost of protecting them against default rose after Germany rejected a call by the International Monetary Fund to increase the size of a 750-billion-euro safety net for debt-stricken members. For details, see [ID:nLDE6B51WU]

Last week, Ireland became the second country after Greece to require an EU/IMF financial rescue and fears are growing Portugal and Spain will be the next to need assistance. That pushed the euro down 7 percent versus the dollar last month.

"What Europe has done is not enough. They have to have eurobonds," John Taylor, chairman and chief investment officer of FX Concepts, told Reuters 2011 Investment Outlook Summit. Taylor runs the world's largest currency hedge fund with assets under management of around $8.5 billion.

"You can't lend money to Ireland or Greece. You're just piling on more debt to them, and it's getting harder and harder to repay."

He said Portugal could be the next country to seek a bailout after Ireland, with Spain after that. This will push the euro to parity versus the dollar by next year, he said.

FOREX-Euro slumps vs dollar as debt worries reemerge

* Euro down vs dlr, 1st time in 4 days on euro zone woes

* FX Concept's Taylor sees euro to parity vs dollar

* Euro zone finance ministers meet (Updates prices, adds quotes, details)

By Julie Haviv

NEW YORK, Dec 6 (Reuters) - The euro fell on Monday as traders took profits from a three-day rally on signs of division over how to contain the euro zone's fiscal crisis.

The euro's weak performance came as euro zone finance ministers met under pressure to boost the size of a rescue fund to stop a debt crisis from spreading.

The euro zone should have a bigger rescue fund for member states in trouble, and the European Central Bank should boost its bond buying to prevent the sovereign debt crisis from derailing economic recovery, an International Monetary Fund report obtained by Reuters said. [nLDE6B40CZ]

"There is a growing discord among euro zone finance ministers, and that is weighing heavily on the euro today," said Andrew Wilkinson, senior market analyst at Interactive Brokers in Greenwich, Connecticut.

"This discord is prompting a resumption of the bearish trend surrounding the euro," he said. "If this discord continues, I fully expect the euro to be tested at $129.86 this week."

Germany's rebuff to the IMF call reinforced this discord. [ID:nLDE6B40EJ]

In early afternoon in New York the euro EUR= was down 0.90 percent at $1.3294 but above the session's low of $1.3245, according to Reuters data.

Peripheral government bond yields widened sharply against those of Germany after four days of narrowing last week.

The United States is headed for a new recession, said John Taylor, chairman and chief investment officer of FX Concepts, and that should boost the U.S. dollar and weigh on commodity prices.

He added that the euro zone is in a difficult financial situation, with Spain likely to be an issue in 2011. That could push the euro to parity versus the dollar by next year, Taylor said at the Reuters Global Investment Summit on Monday.

FOREX-Dollar up on yields; euro slips on Irish downgrade

Dollar supported by higher Treasury yields, U.S. tax cuts

* Euro slips after Fitch downgrades Ireland

* Market awaits 30-yr U.S. debt auction, U.S. jobless claims

(Adds comment, updates throughout)

LONDON, Dec 9 (Reuters) - The dollar edged up on Thursday, still supported by a jump in U.S. Treasury yields this week, while the euro slipped after ratings agency Fitch downgraded Ireland's sovereign debt.

Fitch cut its rating on Ireland to BBB+ to reflect the additional costs of restructuring Dublin's ailing economy and banking sector, after Dublin secured a bailout from its European neighbours last month. [ID:nWLA0394]

The dollar continued to draw support from an extension of U.S. tax cuts announced this week, but further gains were capped as a retreat in the benchmark 10-year U.S. Treasury yield from a six-month high hit on Wednesday quelled demand for the dollar.

Analysts said the extended tax cuts were seen as supportive for the economy and therefore the dollar, while U.S. Treasuries have sold off heavily this week, as the stimulative move fuelled fears of inflation and deteriorating U.S. fiscal health. [US/]

"The latest fixation is the tax issue and that's created a bond angle, and it's created a growth story that is positive for the U.S.," said Daragh Maher, FX strategist at Credit Agricole.

Other analysts said investors were wary of taking on big positions as liquidity dries up towards year end, and this was why the dollar's rise had been limited compared with the jump in Treasury yields.

The dollar index has risen only 0.7 percent this week as the 10-year U.S. Treasury yield has soared around 25 basis points.

"We've seen a corrective move in U.S. Treasuries, whereas at the moment, we don't see a need for such a corrective move in the dollar," said Antje Praefcke, FX analyst at Commerzbank in Frankfurt.

The U.S. bond market may be vulnerable to more selling if a 30-year U.S. Treasury auction on Thursday attracts only limited demand. A 10-year auction on Wednesday saw average demand.

The dollar index .DXY, which tracks the dollar's moves against a currency basket, inched up 0.2 percent to 80.172. It crept above its 100-day moving average at 79.953, which seen as supportive for the U.S. currency.

Thursday, December 9, 2010

GBP: Data on industrial production and manufacturing this morning was mixed

JPY: further reduction of the pair USD / JPY should be limited

The yen weakened slightly during the European session. At least, this means that the yen slightly adjusted after growth on Friday against the background of the employment data from the U.S.. This information was relieved to perceived Japanese authorities. While yesterday talked about the probable need for further quantitative easing by the Fed, the continuation was not followed because of fear of the forex market that the dollar will go to growth, supported by the comments of Bernanke. This is the correct score markets, in our opinion, and if the market it will be followed by the further reduction of the pair USD / JPY should be limited.

The yen weakened slightly during the European session. At least, this means that the yen slightly adjusted after growth on Friday against the background of the employment data from the U.S.. This information was relieved to perceived Japanese authorities. While yesterday talked about the probable need for further quantitative easing by the Fed, the continuation was not followed because of fear of the forex market that the dollar will go to growth, supported by the comments of Bernanke. This is the correct score markets, in our opinion, and if the market it will be followed by the further reduction of the pair USD / JPY should be limited.AUD: Technically, the rally from a pair AUD / USD looks a little tired

CHF: Swiss showed the worst results against the dollar among major currencies this week

Swiss showed the worst results against the dollar among major currencies since the beginning of the week. Domestically, it is quite to be welcomed, if you will be overcome by an annual minimum below 0.95. More importantly, the pair EUR / CHF held above the level of 1.30, after a brief flirtation with this level yesterday. Domestically, we have seen that the unemployment rate remained stable seasonally adjusted at 3.6%. These results came from a downward trend throughout the year to date, but current levels are still above the minimum in 2008 of 2.5%. Prospects for the Swiss is still very much connected with the global appetite for risk, as well as developments in sovereign debt, and SNB did not really want to further strengthen the Swiss franc in early 2011.

Swiss showed the worst results against the dollar among major currencies since the beginning of the week. Domestically, it is quite to be welcomed, if you will be overcome by an annual minimum below 0.95. More importantly, the pair EUR / CHF held above the level of 1.30, after a brief flirtation with this level yesterday. Domestically, we have seen that the unemployment rate remained stable seasonally adjusted at 3.6%. These results came from a downward trend throughout the year to date, but current levels are still above the minimum in 2008 of 2.5%. Prospects for the Swiss is still very much connected with the global appetite for risk, as well as developments in sovereign debt, and SNB did not really want to further strengthen the Swiss franc in early 2011.Thursday, December 2, 2010

Interview with Kathy Lien: “Trade Defensively and Use a Stop”

Today, we bring you an interview with Kathy Lien, the internationally published author, Director of Currency Research of FX360.com and GFT, and co-author of BKForex Advisor, one of the few investment advisory letters focusing strictly on the FX market. She is one of the authors of Investopedia’s Forex Education section and has written for Tradingmarkets.com, the Asia Times Online, Stocks & Commodities Magazine, MarketWatch, ActiveTrader Magazine, Currency Trader, Futures Magazine and SFO. Below, Kathy shares her thoughts on fundamental analysis versus technical analysis, rate hikes in China, forex intervention, and other subjects.

Forex Blog: Can you briefly explain your approach to analyzing the forex markets. Do you prefer technical or fundamental analysis, or a combination of both?

I always use a combination of both fundamentals and technicals because I believe that the story drives the price. Fundamentals usually set the tone for trading and set the trends that lasts for weeks, days and in some cases, even years.

Forex Blog: As head of currency research for GFT Forex, it looks like you cover most of the major currencies, as well as a handful of emerging/exotic currencies. What do you think about the macroeconomic gulf that is forming between the “G4″ economies (US, UK, Eurozone, Japan) and the emerging market economies (along the lines of debt, GDP growth, etc.)? Do you think that this division is reflected in forex markets?

I believe that the gap between the pace of growth in the G4 and the emerging markets will start to close as growth in the U.S. picks up and growth in China slows in reponse to rate hikes.

Forex Blog: You blogged recently about interest rate hikes in China and the possibility that the Chinese economy could slow down. What do you think are the implications for the forex markets?

Slower chinese growth is bearish for the commodity currencies because it means Chinese demand could slow.

Forex Blog: In a recent post entitled, “Dollar: 3 reasons Behind the Rally,” you suggested that the Fed is skeptical that its QE2 program will succeed in stimulating the economy. Can you elaborate on why you think this will benefit the Dollar?

Speculation about QE was the main driver behind the dollar’s weakness in September. If the Fed is skeptical about the effectiveness of QE, they are more likely to pare back the program prematurely which would be dollar positive because it is one step closer to a rate hike.

Forex Blog: It has been said that the Fed is caught in a lose-lose situation, whereby its QE2 will fail and the US economy will drift back into recession or it will succeed in invigorating the economy and stoking inflation. Do you share this interpretation?

I don’t think I agree. The Fed doesn’t have much of a choice right now and options for stimulating the economy are limited. Core Producer prices declined in October which shows that deflation is just as much of a risk as inflation. The dollar will stabilize when the U.S. economy and U.S. data improves which is the Fed’s top priority.

Forex Blog: In a comparison of the Australian and Canadian Dollars, you asserted that while both countries’ economies are based around commodities, “At the end of the day however it is important to remember that Canada is not Australia.” With this in mind, can you elaborate on why the Aussie has a better chance of trading above parity (with the US Dollar) than the Loonie?

Because Australia benefits from Chinese demand and global growth while Canada is mostly sensitive to U.S. growth. The RBA is still considering more rate hikes while the BoC has made it clear that they have intentions of tightening monetary policy in the near term.

Forex Blog: A discussion of the major themes in forex markets wouldn’t be complete without mentioning the ongoing currency wars. First of all, do you think that the label “currency war” is fair? Do you think that most countries’ Central Banks will continue to intervene on behalf of their respective currencies, and do you think they will succeed in preventing them from rising further?

I think if the dollar continues to fall, they will have no choice but to defend their currencies.

Forex Blog: What is your advice for (forex) investors that want to beat the market during these uncertain times?

source: http://www.forexblog.org/2010/11/interview-with-kathy-lien-trade-defensively-and-use-a-stop.htmlTrade defensively and use a stop.

War = Good News for South Korea?

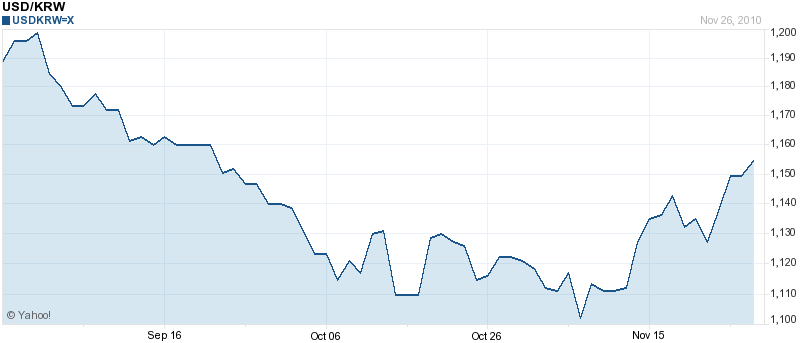

South Korea was in the midst of figuring out what to do with its appreciating Won when disaster struck, in the form of an unprovoked attack from North Korea. Combined with a worsening of the sovereign debt crisis in Europe, the news was enough to send the Won down 5% over the course of a couple weeks. From the standpoint of managing its currency, it looks like the (distant) prospect of war is actually a blessing in disguise.

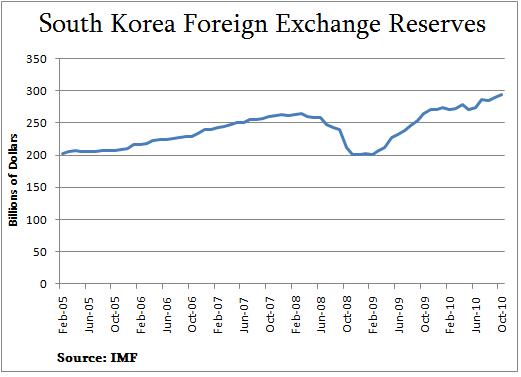

Over the last decade, South Korea has been one of the world’s largest serial interveners in currency markets. Over the last two years alone, as evidenced by the growth in its foreign exchange reserves, it has spent more than $100 Billion defending the Won. As the so-called currency war has intensified, so, too has the Bank of Korea intensified its efforts to hold down the Won, having spent more than $20 Billion since July towards this effort.

You could say then that South Korea’s hosting of the G20 Summit on November 15 put it in a slightly awkward position. Still, it was determined to make clear that it would continue to take steps to combat the rise in the Won. According to Shin Hyun-song, the special economic advisor to President Lee Myung-bak, “This means that countries can intervene in the currency market when the market is in disorder and when there is a gap between the market rate and underlying economic fundamentals.” Of course, fundamentals is hardly an objective notion in this case.

While the G20 predictably called on participants to “move toward a market-driven exchange rate system and to refrain from competitive devaluations,” it nonetheless also guided them towards “implementing policy tools for bringing excessive external imbalances down to sustainable levels.” The underlying message is that certain countries should curtail their reliance on exports and try to achieve more balanced growth.

Naturally, South Korea’s interpretation was that while direct intervention is now taboo, taxes and other capital controls are sanctioned. Thus, it has been reported that “the Korean government has been gauging its timing to launch further measures to tighten the financial market and protect it from volatile global capital movement..bank levies on non-deposit liabilities and taxes on foreign purchases of government bonds are both possible options.”

As I said, though, the South Korea now has some breathing room. Its Won depreciated rapidly in the minutes after the shelling of Yeonpyeong island, which killed four and wounded 20, was first reported. The fact that the US government immediately pledged its support and solidarity (by sending over an aircraft carrier) is not instilling confidence. One analyst indicated, “We see a strong chance of further Korean won weakness in the days ahead as more details emerge, particularly if public opinion in South Korea puts pressure on the government there to take a stronger stance.”

Even before this episode, the EU sovereign debt crisis had spread to Ireland, and put Spain and Portugal at risk, too. As a result, the Dollar-as-safe-haven mindset re-emerged, and spurred some capital movement back to the US. In this context, the drama with North Korea only exacerbated the climate of risk aversion.

Ultimately, both the EU fiscal crisis and the tensions with North Korea will subside, which should cause the Won to resume its rise. (In fact, Korean exporters have come to view this as inevitable, and have taken advantage of the relatively favorable exchange rate to repatriate overseas earnings). At this point, you can expect the Bank of Korea to begin implementing capital controls and continue the face-off with currency markets.

3 Ways You Can Use Moving Averages To Trade The Forex Markets

Moving averages are one of the most popular types of technical indicator amongst forex traders. They can be used in a variety of different ways to help find winning forex positions, and in this blog post I want to discuss three of the main trading methods you can use.

1. Moving Average Crossovers

By plotting two moving averages - a short-term moving average and a long-term moving average - you can get strong trading signals when the short-term one crosses the long-term one because this often signals a change in trend.

So to give you an example, I like to use a 5 period EMA (exponential moving average) and a 20 period EMA on the 4 hour chart. I then wait for the EMA (5) to cross through the EMA (20) to provide me with a strong trading signal (using a couple of other indicators for confirmation).

2. Moving Average Confluence

Another way you can use moving averages is by plotting three or four of these on your chart and then waiting for them all to come together. So if you use 5, 20, 50 and 200 period moving averages, for example, you want to wait for them all to be closely bunched up against each other because this often indicates a period of consolidation, and more importantly that a strong breakout is about to occur.

3. Moving Averages As Price Targets

If you are a long-term trader you can also use long-term moving averages as natural price targets, particularly when trading price reversals. The 200 day moving average (simple or exponential) often acts as a magnet as well as a natural support or resistance level, so it makes sense to think about exiting a position close to this moving average.

Final Comments

You can find out more about how I trade moving average crossovers by filling in the form above and checking out my 4 hour trading system, but you can see what I mean about the other two methods by looking at the daily chart of the GBP/USD pair below.

As you can see, the 5, 20, 50 and 200 period EMAs came together at the start of September, indicating a period of consolidation, and then we had a big breakout to the upside where the price went from 1.55 to 1.61, and ultimately all the way up to 1.63.

We then had a strong price reversal and the EMA (200) again acted as a magnet because the price hit this moving average at around 1.56. On this occasion it acted as a support level very briefly, but this was short-lived and the price has since dipped below this level, which is an ominous sign.

Anyway the point is that there are various ways in which you can use these moving averages to trade the forex markets.

Short-Term Forex Trading

Forex traders trade over a number of different time frames, but today I'm going to discuss short-term trading and look at whether or not you can really make consistent profits trading over such a short time frame.

Well I've traded the markets for a good few years now and although you can definitely make profits from short-term trading, it's a very difficult way to make consistent profits.

This is because when you screen down to the 1 and 5-minute charts, for example, you're basically just looking at noise. Sure there will be times when the price lends itself beautifully to technical analysis, but there will also be times when it's just drifting, seemingly at random.

Also, if you're constantly scalping all day you are likely to get a lot of small wins, but also a lot of times when your stop loss is hit, often immediately if trading short term charts.

Over time this can be quite stressful and not a particularly enjoyable method of trading. Yes there are traders who trade this way and make very good profits, but I myself prefer to look at 4-hour and daily charts to find high probability trades which can play out over a few days.

After all you can often make just as many pips from one or two good longer term trades a week, than lots of smaller positions, and it's unquestionably a lot less stressful. You don't even need to be at your computer all day either because you can just set your stop loss and limit orders and just walk away.

So overall my own opinion from years of trading is that short-term trading is a difficult and stressful way of trading, but that's not to say that's it can't be profitable, it most definitely can, but it's just not for me.

For more forex tips and strategies, including full details of my main 4 hour trading strategy, simply sign up to my newsletter by filling in the short form above.

Scalping The Forex Markets - 2 New Discoveries

Not every trader likes to trade the short-term charts because the moves can be quite random and there is a lot of noise to deal with, which makes it hard to make consistent profits. However Bill Poulos has recently made two new discoveries about forex scalping, one of which relates to a flaw in how 90% of forex traders approach these markets.

He has produced a short video that talks about these two discoveries, and explains how he himself scalps the 'sweet spots' of the major forex markets. You can watch this video by clicking here.

Weekly Trading Update - 22-26 November 2010

My 4 hour trading system (see right for details) has performed very well this week with two winning trades out of two. However the Forex Morning Trade system, which I use every day, only managed to break-even this week. I didn't actually trade the system today or yesterday because of the US holiday period, but it didn't make any difference anyway because both trades would have been stopped out at break-even after moving into profit initially. The full results for this week are as follows:

Monday: +40 points

Tuesday: -40 points

Wednesday: no trade

Thursday: 0 (break-even)

Friday: 0 (break-even)

There have been a few weeks now where the Forex Morning Trade system has only managed to break-even, but it still hasn't had a losing week since I first started trading it in September and I'm sure it will bounce back next week.

Luckily my 4 hour trading system produced the goods this week, as I mentioned earlier. The really successful trade was on the EUR/USD pair. I was waiting for the EMAs to cross downwards for an opportunity to go short, and after they did so I managed to bank a total profit of 100 points.

Rather than go though the details of this trade once more, you can read all about this particular set-up by reading my two previous blog posts:

- Potential Set-Up On The EUR/USD Pair - November 18 2010

- An Update On The EUR/USD Trade That I Mentioned On November 18

The other trade was on the USD/JPY pair and this trade is actually still open at the time of writing. This pair is in an upward trend on the daily chart, as indicated by the Supertrend indicator, so I was looking to go long on any upward EMA crossover on the 4 hour chart, and did so early this morning at 83.50.

I closed half the position for 40 points and moved my stop loss to break-even. I'm now in a quandary as the price is 45 points in profit but the US markets are likely to be very quiet today, so I'm seriously thinking about closing the other half very shortly and shutting up shop for the week.

Anyway whatever happens it has still been a very profitable week.

Have a great weekend, and I hope you're enjoying your Thanksgiving holiday if you're in the US.

Vietnam More Credit Worthy than Portugal and Spain?

You may have read that European bond spreads have widenend to record levels but how bad is that really? To put everything into perspective, investors are demanding more premium to lend to Ireland, Portugal and Spain than to emerging countries in Europe and Asia. To be more specific, these 3 European countries that have made headlines on a daily basis are now considered less credit worthy (or are assumed to be a greater risk) than Romania, Lebanon, Vietnam and Indonesia. The following table shows the current 5 year credit default swap spreads for some of the major countries. Triple A rated countries such as the U.S., Switzerland, Germany, Denmark and Sweden have swap spreads less than 50bp.

For those of you that are unfamiliar, the Credit Default Swap (or CDS) spread is the premium paid by a protection buyer to the protection seller over a length time. If a default occurs, the protection seller would have to cover the losses. The CDS spread is quoted in basis points per annum of the contract’s notional amount.

In case you are curious, the two countries that have the lowest CDS swap spreads and are therefore considered the most credit worthy are Norway and Finland.

Forex Daily Outlook – December 2 2010

US Unemployment Claims and Pending Home Sales are the main events this day .Let’s see what awaits us today.

In the US, Unemployment Claims, individuals who filed for unemployment insurance for the first time during the past week is about to rise by 18K. Important signal of overall economic health.

Later in the US, Pending Home Sales, homes under contract to be sold but still awaiting the closing transaction, excluding new construction is about to rise by 0.9%. Leading indicator of economic health and triggers a wide-reaching ripple effect.

Finally in the US, Federal Reserve Bank of St. Louis President James Bullard, Due to speak on monetary policy and the economy at the National Economists Club, in Washington DC. Audience questions expected. Can affect the nation’s key interest rates.

For more on USD/CAD, read the Canadian dollar forecast.

In Europe, Minimum Bid Rate, Interest rate on the main refinancing operations that provide the bulk of liquidity to the banking system is 1% like on the previous month. Short term interest rates are the paramount factor in currency valuation.

Also in Europe, European Central Bank (ECB) Press Conference, It’s the primary method the ECB uses to communicate with investors regarding monetary policy. It covers in detail the factors that affected the most recent interest rate and other policy decisions, such as the overall economic outlook and inflation. Most importantly, it provides clues regarding future monetary policy.

More in Europe, Producer Price Index (PPI), price of finished goods and services sold by producers should rise by 1%. Tends to have a muted impact because Germany and France, which account for about half of the Eurozone’s economy, release their PPI data earlier.

Finally in Europe, Revised Gross Domestic Product (GDP), all goods and services produced by the economy should be 0.4% like on the previous month.

For more on the Euro, read the EUR/USD forecast and Casey Stubbs’ latest analysis.

In Great Britain, Halifax HPI, price of homes financed by HBOS; price of homes financed by HBOS is about to reduce by 1.5%. Leading indicator since rising house prices attract investors and spur industry activity,

More in Great Britain, Construction Purchasing Managers’ Index (PMI); Survey of about 170 purchasing managers which asks respondents to rate the relative level of business conditions including employment, production, new orders, prices, supplier deliveries, and inventories indicates industry expansion wotj 51.1 points.

Read more about the Pound in the GBP/USD forecast.

In Switzerland, Retail Sales at the retail level, excluding automobiles and gas stations is about to rise by 0.8%, and primary gauge of consumer spending, which accounts for the majority of overall economic activity.

More in the Switzerland, Gross Domestic Product (GDP) is about to reduce by 0.4%.

In Australia, Retail Sales, value of sales at the retail level; is about to rise by 1% and primary gauge of consumer spending, which accounts for the majority of overall economic activity.

More in Australia, Trade Balance, value between imported and exported goods and services during the reported month is about to rise by 0.31B. Export demand and currency demand are directly linked.

For more on the Aussie, read the AUD/USD forecast.

In Japan, Capital Spending dropped in the previous quarter 1.7% less than the 6.6% drop expected. For the first time in nearly 2 years a 6.1% gain is expected showing signs of recovery in the market.

That’s it for today. Happy forex trading!

Euro Disney – Trichet Downplayed the Markets while Buying Bonds

While Jean-Claude Trichet was speaking about price stability and not committing to any grand quantitative easing program, the ECB was apparently working hard in – buying bonds. Jamie Coleman reports about the bond buying and that the numbers will be published on Monday.

During the press conference, it seemed that Trichet wasn’t delivering, sounding too calm and distanced from the credit crisis. EUR/USD fell from 1.3180 down to 1.3060. It’s now back up to 1.3070. Quite amazing. Spanish bond yields are still above the levels before the press conference, at 5.13%, lower than the peak in the middle of the event – 5.15%.

Izabela Kaminska, on Alpahville, brings some numbers:

Started evidently in bidding for 10 -25 mln € clips and then moved onto 100 mln € clips … which is very rare indeed evidently

Amazing.

Update 15:10 EUR/USD marching forward and crossed 1.32. This is a line of resistance. 1.3267 and 1.334 are next.

The Bundesbank will resist calls for the ECB to expand purchases of bonds

euros, which can be characterized as the second part of "shock and awe" from European officials, as they desperately seek to draw a line under this latest debt crisis. It is not clear whether the ECB is ready to expand its program to repurchase assets (now 67 billion euros), monetary instruments, which made a strong passions within the ECB, particularly among the Bundesbank. What could have happened last week, so this is what the ECB is very powerfully pressed during the discussion of Ireland's aid package. While Trichet is in itself probably would prefer to minimize the program or at least not increase, the ECB may assume that a non-functioning markets provide some justification for intervention in peripheral markets, especially if they are completely sterilized. The Bundesbank is particularly opposed to any expansion of the program buying bonds - he rightly takes the position that the ECB takes on its balance sheet more credit risk, and that he reiterated the Central Bank is required to save wasteful periphery. However, further purchases of bonds by the ECB in the existing scales are not a panacea for the current debt crisis - is nothing more than yet another patch for the euro used a broken leg.

CHF/USD: Swiss Franc did not take the parity of the dollar this week

The main feature of the Swiss franc this week is the inability to break through parity against the dollar, which hold 2 / 3 cents for the week. The fact that he held yesterday, a day of growth in demand for risky assets, stocks, forex, says that the U.S. dollar and Swiss perceived as a safe haven at the moment. More characteristic of this was evident on the pair EUR / CHF, where the euro has increased by more than 2 cents against the Swiss in the environment. This may well be heading for a month with a higher volatility in pairs EUR / CHF vs. USD / CHF, especially when their number is reduced by the end of the year. GDP data for the third quarter this morning, rising more than expected, and growth in comparison with the previous quarter was 0.7% in the second quarter growth was 0.8%. Domestic demand was quite sure from the previous quarter and up 2.2% against decrease in net trade to GDP data. All this underscores why the SNB, probably will continue to closely monitor the Swissotel in the coming months, fearing that the future growth of the currency may undermine the recovery of the Swiss economy.

Forex: Euro To Face Increased Headwinds As ECB Maintains Current Policy, U.S. Dollar To Benefit As Market Sentiment Falters

Talking Points

- Japanese Yen: Continues To Lose Ground As Risk Appetite Returns

- British Pound: Construction Expands At Faster Pace in November

- Euro: GDP Expands 0.4% in Third Quarter

- U.S. Dollar: Pending Home Sales on Tap

The Euro pared the overnight advance as the European Central Bank talked down speculation for further easing, and the single-currency is likely to face increased headwinds over the near-term as the Governing Council refrains from addressing the risk for contagion. ECB President Trichet reiterated that monetary policy remain ‘appropriate’ during the press conference, and said inflation expectations remain firmly anchored as the central bank maintains its one and only mandate to ensure price stability. In addition, the central bank head noted that its exit strategy will be delayed as the governments operating under the fixed-exchange rate system struggle to manage their public finances, and went onto say that the uncertainties surrounding the economic outlook remains highly elevated as the financial system remains fragile.

As a result, Mr. Trichet said that the emergency measures will be an ‘ongoing’ program as the central bank aims to stem the risks for the region, but the lack of additional monetary easing could lead the bearish momentum behind the single-currency to gather pace throughout the remainder of the year as market participants speculate Spain and Portugal to share Ireland’s fate. Meanwhile, the preliminary GDP reading for the Euro-Zone showed economic activity expanded 0.4% in the third-quarter, which was largely in-line with expectations, while gross fixed capital formations held steady during the three-months through September amid projections for a 0.4% rise. A deeper look at the report showed household consumption increased 0.3% during the same period, which exceeded an initial forecast for a 0.2% rise in private spending, while government spending advanced 0.4% versus expectations for a 0.3% expansion. As the outlook for growth and inflation remains weak, the Governing Council could face increased pressures to take additional steps as the economic recovery in the Euro-Zone tapers off, and we expect the EUR/USD to completely retrace the advance from September as European policy makers struggle to restore investor confidence.

The British Pound fell back from a high of 1.5666 during the European trade to maintain the narrow range from earlier this week, and the GBP/USD may hold steady throughout the day as investors eagerly wait for the U.S. non-farm payrolls report due out tomorrow at 13:30 GMT. As the GBP/USD continues to trade below the 38.2% Fibonacci retracement from the 2009 low to high around 1.5700, we are likely to see the pair continue to trend sideways throughout the North American trade, but a shift in market sentiment could spark increased volatility in the exchange rate as risk trends continue to dictate price action in the currency market. Nevertheless, the economic docket showed construction in U.K. unexpectedly expanded at a faster pace in November, with the PMI reading advancing to 51.8 from 51.6 in the previous month, and the Bank of England may see scope to start normalizing monetary policy in the beginning of 2011 as the recovery gradually gathers pace. Given the stickiness in price growth, the BoE may turn increasingly hawkish as they expect inflation to hold above target throughout the following year, and interest rate expectations may gather pace over the coming months as growth and inflation accelerates.

U.S. dollar price action was mixed overnight, with the USD/JPY holding within the previous day’s range, and the major currencies may hold steady ahead of the non-farm payrolls release due out tomorrow as market participants expect the U.S. labor market to improve for the second consecutive month in November. Nevertheless, pending home sales in the world’s largest economy is forecasted to contract 1.0% in October after slipping 1.8% on the previous month, and the data could weigh on market sentiment as it reinforces a weakened outlook for future growth. As the economic docket remains fairly light for Thursday, we expect risk trends to dictate price action throughout the North American trade, and the rebound in risk appetite may gather pace as equity futures foreshadow a higher open for the U.S. market.

Will the EUR/USD Retrace The Advance From September As European Debt Woes Intensify? Join us in the Forum

Related Articles: Forex Weekly Trading Forecast - 11.29.10

To discuss this report contact David Song, Currency Analyst:dsong@fxcm.com

FX Upcoming

| Currency | GMT | EST | Release | Expected | Prior | |

| USD | 13:30 | 08:30 | Continuing Claims (NOV 20) | 4200K | 4182K | 0.7% |

| USD | 13:30 | 08:30 | Initial Jobless Claims (NOV 27) | 425K | 407K | |

| USD | 15:00 | 10:00 | Pending Home Sales (MoM) (OCT) | -1.0% | -1.8% | |

| USD | 15:00 | 10:00 | Pending Home Sales (YoY) (OCT) | -- | -24.9% | |

| | ||||||

| | ||||||

| Currency | GMT | Release | Expected | Actual | Comments | |

| JPY | 23:50 | Capital Spending (3Q) | 6.0% | 5.0% | Rises for the first time since 1Q 2007. | |

| JPY | 23:50 | Capital Spending Ex. Software (3Q) | 6.0% | 4.8% | ||

| JPY | 23:50 | Monetary Base (YoY) (NOV) | -- | 7.6% | Fastest pace of growth since May 2009. | |

| AUD | 00:30 | Retail Sales (MoM) (OCT) | 0.4% | -1.1% | First decline since February. | |

| AUD | 00:30 | Trade Balance (AUD) (OCT) | 2000M | 2625M | Highest since June. | |

| EUR | 06:30 | French ILO Mainland Unemployment Rate (3Q) | 9.4% | 9.3% | Unchanged for 2nd month. | |

| EUR | 06:30 | French ILO Unemployment Rate (3Q) | 9.8% | 9.7% | Remains near multi-year highs. | |

| EUR | 06:30 | French Mainland Unemployment Change (3Q) | -- | -1K | Drops after 2 rises. | |

| CHF | 06:45 | GDP (QoQ) (3Q) | 0.5% | 0.7% | 3rd straight slowdown. | |

| CHF | 06:45 | GDP (YoY) (3Q) | 3.1% | 3.0% | Best since Q2 ’08. | |

| CHF | 08:15 | Retail Sales (YoY) (OCT) | -- | 3.5% | Falls back from spike higher in Sept. | |

| GBP | 09:30 | PMI Construction (NOV) | 51.3 | 51.8 | Bounces back after sharp dip in Oct. | |

| EUR | 10:00 | Euro-Zone GDP (QoQ) (3Q) | 0.4% | 0.4% | Slips back after surging in Q2. | |

| EUR | 10:00 | Euro-Zone GDP (YoY) (3Q) | 1.9% | 1.9% | 3rd straight expansion. | |

| EUR | 10:00 | Euro-zone Gross Fixed Capital (QoQ) (3Q) | 0.4% | 0.0% | Holds flat for first time since 4Q 2000. | |

| EUR | 10:00 | Euro-zone Household Consumption (QoQ) (3Q) | 0.2% | 0.3% | Remains at fastest pace in years. | |

| EUR | 10:00 | Euro-zone PPI (MoM) (OCT) | 0.3% | 0.4% | Fastest since April. | |

| EUR | 10:00 | Euro-zone PPI (YoY) (OCT) | 4.3% | 4.4% | Fastest since Oct ’08. | |

| EUR | 10:00 | Euro-zone Govt Expenditure (QoQ) (3Q) | 0.3% | 0.4% | 3rd expansion since contacting in Q4 ’09. | |

| EUR | 12:45 | ECB Rate Decision | 1.00% | 1.00% | Holds rate in order to stem downside risks for the region. | |

Wednesday, December 1, 2010

Australian Dollar Still Finding Bids Despite Softer GDP; What Gives?

Although the Australian Dollar has come off in Wednesday trade following the release of the weaker than expected GDP data, we do not feel the currency has come off nearly as much as it should in light of this development. Instead, the single currency is only mildly offered on a relative basis to this point, with the stronger China PMI data seen as the offsetting prop against any setbacks. Given the strong dependence of the Australian economy on China, any strength in Chinese economic data is perceived to be a net positive for Australia. However, ironically, the stronger China data may only serve to ultimately weigh on the Australian economy some more, with China in the process of aggressively looking to raise rates in an effort to curb inflation.

Meanwhile, at the same time, RBA Stevens has adopted a more dovish outlook on the local economy and has signaled an end to additional tightening for the time being. To us, this is a recipe for a good deal of relative weakness in the Australian Dollar going forward, and we like playing the anticipated weakness through the Euro with the Eur/Aud cross highly oversold on a longer-term basis and looking du for a sizeable bounce over the coming weeks and months. As such, we have recommended a fresh long position in EUR/AUD at 1.3580 with an open objective and stop-loss only if the market puts in a daily close below 1.3450.

Elsewhere, the Greenback remains very well bid cross the board but also looks to be overbought on the daily charts and could be poised for a pullback over the coming sessions. The break below 1.3000 in Eur/Usd has left the daily RSI below 30 and we would not at all be surprised to see a bounce of a couple hundred points to allow for studies to unwind so that the market can seek out a fresh lower top ahead of an eventual bearish resumption. In our opinion, given that the Euro has been the most beaten down currency in recent days, it stands to benefit the most should the markets begin to reverse course on Wednesday and Thursday.

Nevertheless, risk aversion and market uncertainty are still running quite high and the news of S&P placing Portugal on credit watch with warnings of a potential downgrade to foreign and local currency sovereign credit ratings has not helped matters. The Swiss Franc has been another prime beneficiary of the latest wave of safe haven buying, with the Eur/Chf cross plummeting below 1.3000 on Tuesday. But here too we see the market well overdone and very much due for a necessary upside reversal. We have established a long position on this cross by 1.2995 on Tuesday and are optimistic with the prospects for a bounce over the coming sessions.

Looking ahead, UK Nationwide house prices and German retail sales are due at 7:00GMT, with Swiss SVME PMI shortly after at 8:30GMT. German manufacturing PMI is then out at 8:55GMT, with Eurozone manufacturing PMI immediately following at 9:00GMT. UK manufacturing PMI then rounds things out for European trade at 9:30GMT. US equity futures and commodity prices are tracking moderately higher on the day thus far.

Written by Joel Kruger, Technical Currency Strategist

If you wish to receive Joel’s reports in a more timely fashion, email jskruger@fxcm.com and you will be added to the distribution list.

FOREX: US Dollar Selling to Continue as Chinese PMI Spurs Risky Assets

Key Overnight Developments

- NZ Dollar Outperforms as Chinese PMI Stokes Risky Assets

- Australian GDP Falls Short of Expectations in Third Quarter

Critical Levels

| CCY | SUPPORT | RESISTANCE |

| EURUSD | 1.2940 | 1.3107 |

| GBPUSD | 1.5512 | 1.5623 |

The Euro advanced in overnight trade, adding 0.4 percent against the US Dollar amid a broad recovery in most risk-linked currencies following firm Chinese PMI figures (see below). The British Pound was little changed, oscillating in a familiar range above 1.5550 to the greenback. We remain long the US Dollar against the Euro, Kiwi and Japanese Yen.

Asia Session Highlights

| CCY | GMT | EVENT | ACT | EXP | PREV |

| AUD | 22:30 | AiG Performance of Manufacturing Index (NOV) | 47.6 | - | 49.4 |

| AUD | 0:30 | Gross Domestic Product (QoQ) (3Q) | 0.2% | 0.4% | 1.1% (R-) |

| AUD | 0:30 | Gross Domestic Product (YoY) (3Q) | 2.7% | 3.4% | 3.1% (R-) |

| CNY | 1:00 | PMI Manufacturing (NOV) | 55.2 | 54.8 | 54.7 |

| JPY | 1:30 | BOJ’s Suda Will Speak in Yamagata City | - | - | - |

| NZD | 2:00 | ANZ Commodity Price (NOV) | 4.5% | | 2.9% |

| CNY | 2:30 | HSBC Manufacturing PMI (NOV) | 55.3 | 55.4 | 54.8 |

| JPY | 5:00 | Vehicle Sales (YoY) (NOV) | -30.7% | - | -26.7 |

| AUD | 5:30 | RBA Commodity Index SDR (YoY) (NOV) | 44.4% | - | 47.5% (R+) |

| AUD | 6:30 | RBA Commodity Price Index (NOV) | 92.7 | - | 93.1 (R+) |

The New Zealand Dollar outperformed in overnight trade, rising against all of its major counterparts after Chinese Manufacturing PMI showed the sector’s growth accelerated more than economists expected in November, hitting a seven-month high. The outcome underpinned stock exchanges, sending the MSCI Asia Pacific regional benchmark index higher to the tune of 0.9 percent and boosting risk-correlated currencies.

The Australian Dollar did not perform as well as its antipodean counterpart, unable to fully capitalize on favorable risk trends after Gross Domestic Product figures showed growth fell short of expectations in the third-quarter, with output adding 0.2 percent from the three months through June. Still, the Aussie proved relatively well-supported as the outcome served to do little more than reinforce already lackluster rate hike expectations that have been priced in at least since last week’s acutely dovish speech from RBA Governor Glenn Stevens.

Euro Session: What to Expect

| CCY | GMT | EVENT | EXP | PREV | IMPACT |

| GBP | 7:00 | Nationwide House Prices n.s.a. (YoY) (NOV) | 0.5% | 1.4% | Medium |

| GBP | 7:00 | Nationwide House Prices s.a. (MoM) (NOV) | -0.4% | -0.7% | Medium |

| EUR | 7:00 | German Retail Sales (MoM) (OCT) | 1.2% | -1.7% | Medium |

| EUR | 7:00 | German Retail Sales (YoY) (OCT) | 1.3% | 0.4% | Low |

| CHF | 8:30 | SVME-Purchasing Managers Index (NOV) | 59.5 | 59.2 | Medium |

| EUR | 8:45 | Italian Purchasing Manager Index Manuf. (NOV) | 53 | 53 | Low |

| EUR | 8:50 | French Purchasing Manager Index Manuf. (NOV F) | 57.5 | 57.5 | Low |

| EUR | 8:55 | German Purchasing Manager Index Manuf. (NOV F) | 58.9 | 58.9 | Medium |

| EUR | 9:00 | Euro-Zone Purchasing Manager Index Manuf.(NOV F) | 55.5 | 55.5 | Medium |

| GBP | 9:30 | Purchasing Manager Index Manufacturing (NOV) | 54.7 | 54.9 | Medium |

Stock index futures are ticking firmly higher ahead of the opening bell in Europe, hinting the recovery in risk appetite noted in Asia in the wake of better-than-expected Chinese PMI figures is poised to carry forward.

A handful of analogous European reports promises to reinforce the “risk-on” tone: final revisions of German and Euro Zone PMI are expected to confirm improvements in November while the Swiss SVME PMIgauge points to a rebound after activity slowed over the preceding three months. UK PMI is set to moderate, but only slightly so, having snapped a four-month losing streak in the previous month.

Elsewhere, German Retail Sales are set to add 1.2 percent in October – marking the first increase since July – while another dour UK House Prices survey seems unlikely to sour the mood considering the deteriorating health of the property market has been evident for some time now and has likely been priced into exchange rates.

A bond auction in Portugal will be met with caution however, with poor uptake likely to translate into renewed fears that the southern European country is next in line for a Greek- and Irish-style sovereign flare up. Portuguese credit-default swap (CDS) spreads dutifully rose 1.8bps ahead of the offering.